When you’re buying a new property in Singapore, you’ll need to understand how the Progressive Payment Scheme works. It’s not as simple as paying everything upfront – instead, you’ll make payments at different stages of construction. This system affects how you plan your finances, loan arrangements, and CPF usage. Whether you’re a first-time buyer or seasoned investor, knowing these payment milestones can save you from unexpected financial strain and also help you prepare better when you buy a new condo that is under construction.

Understanding the Progressive Payment Scheme Framework

The Progressive Payment Scheme breaks down your property payments into clear, manageable milestones that match the construction timeline. This payment structure puts you in control, ensuring you only pay for completed work on your property in stages.

Your developer will notify your legal team when each construction phase is complete. This ‘milestone tracking system’ protects your interests by linking payments directly to visible progress, based on the amount of work done. You’ll have two payment options: direct cash payment or bank loan disbursement.

The scheme’s flexibility adapts to any construction delays, automatically adjusting payment schedules to match actual progress. This means you won’t be pressured to pay for unfinished work.

You maintain control over your investment while the developer stays accountable for delivering each promised construction phase.

Key Stages and Payment Percentages

Understanding the payment stages in the progressive payment schedule helps you plan your finances and understand the whole construction timeline better.

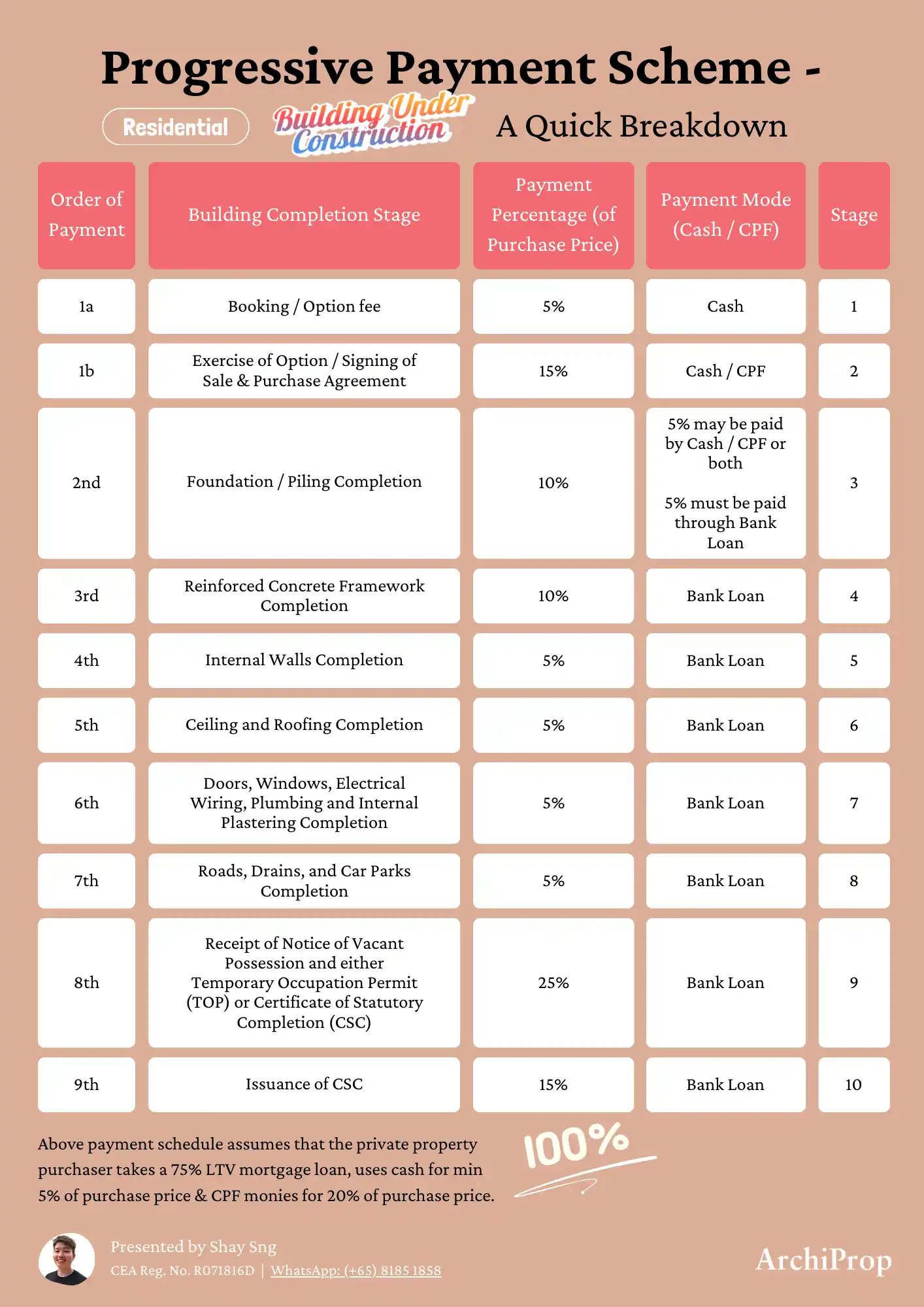

The key milestones begin with a 5% booking fee, followed by a 15% downpayment within 8 weeks. You also have to pay Buyer’s Stamp Duty ranging from 1% to 4%, legal fees between $2,500-$5,000, and a valuation fee of $350-$500. Additional Buyer’s Stamp Duty may also apply if you already own at least one residential property before this current new purchase.

The payment structure then progresses through various construction phases, with 10% due at foundation completion and another 10% for concrete framework.

You’ll pay 5% each for partition walls, roofing, plumbing, and external works. The largest payments come near the end: 25% at Temporary Occupation Permit (TOP) and 15% at legal completion.

Each stage correlates with specific construction progress, giving you control over your investment timing. The table below outlines clearly the respective stages and percentages of payment during the construction process. It’s based on the scenario where you will be taking a 75% LTV of the property price as the bank loan (which means 25% to be paid in cash or CPF.

How Does the Progressive Payments Work?

When you buy a property under this scheme, your monthly payments begin at different points based on your loan amount. The payment structure directly ties to your loan-to-value ratio, giving you control over when your disbursements start.

If you’ve secured a 75% loan, you’ll begin your payments once the foundation stage is complete, which is the first stage of the schedule. This marks your first disbursement timing and kicks off your monthly instalments.

However, if you decide to go for a loan-to-value that is less than 75%, for example, a 60% loan, you will first fork out cash or CPF to pay off the initial stages until the cash / CPF portion reaches 40% of the purchase price. Then the bank will start disbursing the 60% loan for the remaining stage. This means that you won’t start paying bank loan instalments until the walls stage is completed.

CPF Usage Guidelines For New Private Residential Properties

There’s a CPF Housing Scheme which governs how and whether you can use your CPF OA savings when purchasing a residential property. The table below shows the specific allowable or non-allowable uses of CPF OA savings with regard to buying a new launch residential property.

If you have already used CPF savings for a residential property that you currently own, there will be additional restrictions when you use your CPF savings for a second or subsequent residential property.

Before you can use the excess savings in your CPF OA, you will need to:

- Set aside the latest Basic Retirement Sum (BRS) if you have at least one property bought using CPF or the property that you are buying can cover you till age 95

- Set aside the latest Full Retirement Sum (FRS) if you do not have any property that can cover you till age 95

The maximum amount of CPF that can be used for your second or subsequent residential property depends on the remaining lease of the second or subsequent property and whether the lease can cover the youngest owner using CPF for this purchase until the owner is 95 years old.

Advantages of New Launch Progressive Payment Schemes

Progressive payment plans offer clear advantages for new launch condo buyers. You’ll pay in stages that match the construction timeline, making it easier to manage your finances.

This structured approach allows your instalments to gradually increase over time, and you will also be able to estimate when the instalments kick in and allow yourself time to prepare for it.

The investment potential of new launch condos becomes more attractive with progressive payments. You’re not paying the full amount upfront, which means that you can put your money to ‘work’ elsewhere while the construction is still ongoing.

As the project develops, your property’s value may increase, giving you capital appreciation before you even move in. This payment flexibility, combined with the potential for value growth, makes new launch condos rather attractive to budding or experienced property investors or buyers.

Downsides of Progressive Payment Schemes

Despite their structured benefits, progressive payment schemes come with notable risks for new launch condo buyers. When construction delays happen, you’ll still need to maintain your financial readiness for upcoming payments, even though completion dates shift. This creates uncertainty in your payment timing and can mean your cash is laying idle.

As a buyer, you’ll face risks if you can’t meet the strict payment deadlines at each construction milestone. Missing payments could result in penalties or even termination of the Sales and Purchase Agreement.

You’ll need substantial cash reserves or reliable financing options to handle these scheduled payments, regardless of any personal financial changes that might occur during the construction period. The scheme’s inflexibility means you must align your finances precisely with the developer’s timeline, leaving little room for adjustment.

Conclusion

Having a Progressive Payment Scheme can help you manage your property purchase costs better by spreading them over a few years. This makes buying a new home more manageable although it demands more careful planning and effort to ensure regular and on-time payments. Payments are tied to building completion stages, so you won’t pay for unfinished work. You will also be more aware of the construction milestones, and hopefully will then look forward even more to receiving the Notice of Vacant Possession, once the building obtains the Temporary Occupation Permit (TOP).