As always, there are usually a lot of attention on new launch condo projects, as many people have a penchant for shiny new homes. Property investors may also prefer new launch units as units that are under construction are usually at the cheapest as they just entered the property market. There is a curiosity factor where people will want to check things out, and it is more straightforward to secure a unit from the developer directly.

The Core Central Region (CCR) has long been seen as the most premium location for properties. People who want to stay in a new private home in the CCR generally belong to a different profile as compared to those who are looking at the Outside Central Region (OCR). Besides locals who are looking at living in the heart of the city, expats and foreigner who want to own a new condo unit in Singapore usually will choose CCR as their new home location.

Let’s focus on the CCR in this article. Here, you will find a quick breakdown on nine new launch condos in 2025 in Singapore’s Core Central Region (CCR). This will bring the number of new launch units to approximately 3,600 units to market in the CCR – a massive increase from 2024’s 313 units.

Singapore Central Core Region Broad Market Analysis

The Central Core Region’s new condo launches present compelling investment opportunities, especially for buyers seeking long-term value appreciation.

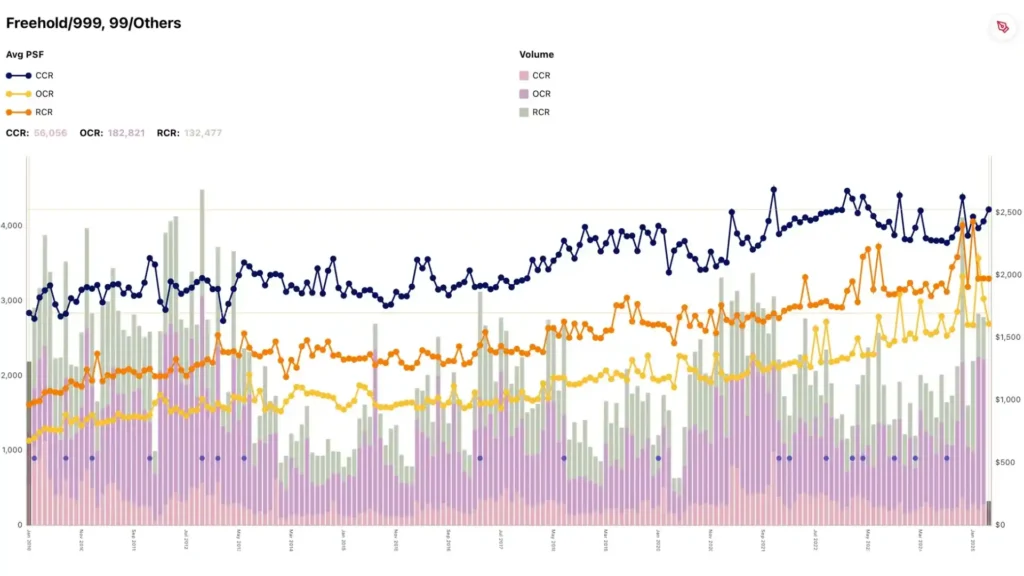

In the past few years, prices of Rest of Central Region (RCR) and Outside Central Region (OCR) have risen while CCR prices have stagnated. This leads to a narrowing price gap between RCR / OCR and CCR properties. Is this then an opportune moment to enter the CCR market? What will happen next – Will there be a continued reduction of price gap (RCR and OCR prices becoming similar to CCR prices), or will CCR prices pull away?

Based on the chart above, we can see that historically,

- All three regions enjoy an overall steady uptrend in prices over the past 15 years.

- CCR prices command a reasonable premium over RCR and OCR. Condo developments are pricier due to their luxury positioning, prime estate land and being at the Central Business District (CBD).

- Each time there is a narrowing price gap between the 3 regions, CCR will pull away from RCR and OCR and normalise their price differences again.

The current and upcoming market supply of new private condos in the CCR

While the Core Central Region (CCR) saw limited launches in 2024 with only 313 units, 2025 promises a significant turnaround with approximately 3,600 units across nine new CCR developments.

Notable projects include One Marina Gardens near Marina Bay Sands and Marina South MRT, with prices ranging from $2,474 to $2,953 psf. With narrowing price gaps between regions and strong local buyer demand at 83%, these premium developments offer compelling investment opportunities worth exploring further.

The 10 already launched / upcoming new launch CCR projects launching in 2025

The Collective at One Sophia

| Location | Sophia Road |

| District | D09 – Orchard / River Valley |

| Mukim/Lot No. | TS19 Lot 00220P |

| Developer | Singhaiyi / CEL / KSH |

| Tenure | 99 years leasehold |

| Tenure Commenced From | 06 Dec 2023 |

| Expected TOP | Dec 2029 |

| Unit Type | 1br, 2br, 3br |

| Number of Units | 367 |

| Site Area | 76,618 sq ft |

| Gross Floor Area (GFA) | 604,576.6 sq ft |

On the site of the former Peace Centre, The Collective at One Sophia is a mixed development developed by Singhaiyi. It is located next to Wilkie Edge and Sunshine Plaza, and is right in the centre of Bugis and the Arts and Cultural District belt in Singapore.

The Collective at One Sophia has two 2 blocks of 19-storey apartments, a 13-storey office and a retail shop podium below occupying the Basement 1, Level 1 and 2. It is also within a 10-min walk to 5 different MRT stations – Rochor and Bencoolen (Downtown Line), Little India (North-East, Downtown Lines), Dhoby Ghaut (North-South, North-East and Circle Lines), and Bugis (East-West, Downtown Lines).

The Collective at One Sophia is now available for viewing.

Aurea

| Location | 802 Beach Road |

| District | D07 – Beach Road / Bugis / Rochor |

| Mukim/Lot No. | TS15 Lot 00359T |

| Developer | GMC Property Pte Ltd |

| Tenure | 99 years leasehold |

| Tenure Commenced From | 18 Nov 2024 |

| Expected TOP | Q2 2029 |

| Unit Type | 2br, 3br, 4br, 5br, Penthouse |

| Number of Units | 188 |

| Site Area | 144,908 sq ft |

| Gross Floor Area (GFA) | 811,479.2 sq ft |

Aurea is part of the redevelopment and conservation of the existing Golden Mile Complex. It is the residential component that connects to the commercial Golden Mile building via a link bridge.

It has a great spread of different unit types (2 bedder to Penthouses), panoramic views of Kallang Basin and the Marina Bay area, which includes Gardens by the Bay, Singapore Flyer, Marina Bay Sands. Being so close to the city but also located next to the tranquil Kallang Basin is a key unique feature.

As for the the Golden Mile, there are 156 office units and 19 medical suites that will be put up for sale. The retail shops, occupying more than 120,000 sqft of GFA over a 2-storey retail podium, will have Perennial Holdings as the managing operator over the retail tenants.

(Note: Though Aurea is being marked as being in the CCR, D07 is basically in the RCR, although some parts of District 07 are in the CCR).

Aurea is now available for viewing.

One Marina Gardens

| Location | 1, 3, 5 Marina Garden Lane |

| District | Rochor D01 – Boat Quay / Raffles Place |

| Mukim/Lot No. | TS30 Lot 00713P |

| Developer | Kingsford Marina Development Pte Ltd |

| Tenure | 99 years leasehold |

| Tenure Commenced From | 09 Oct 2023 |

| Expected TOP | Apr 2029 |

| Unit Type | 2br, 3br, 4br, 5br, Penthouse |

| Number of Units | 937 |

| Site Area | 131,805.2 sq ft |

| Gross Floor Area (GFA) | 738,113.6 sq ft |

The first new project in Marina Bay, One Marina Gardens will enjoy a ‘first-mover’ advantage as the area gets developed in the coming years and welcome new residential and commercial developments.

Comprising of two blocks of 30 and 44 storeys, One Marina Gardens will also have a commercial space including two restaurant units, two shop units and a childcare centre on the ground floor.

The 99-year leasehold residential high rise development is close to the upcoming Marina South MRT station (Thomson-East Coast Line), and will be linked via an underground connection. An underground connection will also allow residents of One Marina Gardens to walk directly to Gardens by the Bay.

One Marina Gardens is now available for viewing.

W Residences Singapore – Marina View

| Location | 22 Marina View |

| District | D01 – Boat Quay / Raffles Place |

| Mukim/Lot No. | TS30 00483K and 00484N |

| Developer | IOI Properties Group |

| Tenure | 99 years leasehold |

| Tenure Commenced From | 27 Dec 2021 |

| Expected TOP | 2028 |

| Unit Type | 1br, 2br, 3br, 4br, 5br, Penthouse |

| Number of Units | 683 |

| Site Area | 84,148 sq ft |

| Gross Floor Area (GFA) | 855,938.8 sq ft |

W Residences Singapore – Marina View is one of the very rare branded residences that comes integrated with hospitality services. Sitting atop W Hotel (Managed by Marriott International) which will have 540 hotel rooms, W Residences Singapore – Marina View will be a different private condo from the rest that we have seen so far in the CCR.

At 51 storeys high (Residences plus hotel combined), the lobby to W Residences is at level 4, with a huge spread of amenities on different floors. Besides the usual condo facilities, there will also be hotel-style services (like 24/7 concierge) and amenities for residents to enjoy at the 15th, 34th and 51st storeys.

It’s expected that staying in such a luxurious condo residence will feel like staying in a hotel all year round, with networking opportunities to meet new individuals for social gatherings and businesses.

W Residences Marina View is expected to commence preview at end Jun 2025.

Upperhouse (Orchard Boulevard Residences)

| Location | Orchard Boulevard Road |

| District | D10 – Tanglin / Holland / Bukit Timah |

| Mukim/Lot No. | TS24 02401M |

| Developer | UOL Group Limited and Singapore Land Group (SingLand) |

| Tenure | 99 years leasehold |

| Tenure Commenced From | TBC |

| Expected TOP | 2028 |

| Unit Type | 1br, 2br, 3br, 4br, 5br |

| Number of Units | 280 |

| Site Area | 73,195 sq ft |

| Gross Floor Area (GFA) | 376,737 sq ft |

The Urban Redevelopment Authority’s is aiming to make the Orchard area more pedestrian friendly, more accessible by public transport and cementing Orchard Road’s spot as the premier shopping destination for both locals and foreigners. Orchard Boulevard Condo (Name to be finalised) looks set to be the beneficiary of this Orchard enhancement.

Situated minutes drive away from so many shopping centres and good local and international schools like Chatsworth International School, there is a lot of emphasis on being a confluence of convenience, activities, and amenities living in Orchard Boulevard Residences.

Orchard Boulevard Residences is expected to commence preview at Q3 2025.

Skye at Holland (previously known as Holland Drive Residences)

| Location | Holland Drive |

| District | D10 – Tanglin / Holland / Bukit Timah |

| Mukim/Lot No. | MK04 07544K |

| Developer | CapitaLand, UOL, Singapore Land, Kheng Leong |

| Tenure | 99 years leasehold |

| Tenure Commenced From | Aug 2024 |

| Expected TOP | 2028 |

| Unit Type | 1br, 2br, 3br, 4br |

| Number of Units | 680 |

| Site Area | 132,805.1 sq ft |

| Gross Floor Area (GFA) | Approx. 1,429,541 sq ft |

Located next to One Holland Village and the popular and bustling Holland Village, Skye at Holland is positioning itself to be a vibrant lifestyle residence for locals and expats. There will be no shortage of eateries and bars in the Holland Village estate.

It is also within walking distance from Holland Village MRT Station (Circle Line) and a short drive from AYE, which means convenience will not be limited to just the Holland Village vicinity, but also other nearby locations like Buona Vista, Harbourfront and Marina Bay.

Skye at Holland is expected to commence preview at Q3 2025.

River Green

| Location | River Valley Green |

| District | D09 – Orchard / River Valley |

| Mukim/Lot No. | TS21 01687M |

| Developer | Wing Tai Holdings |

| Tenure | TBC |

| Tenure Commenced From | 2029 |

| Expected TOP | 2028 |

| Unit Type | Studio, 1br, 2br, 3br, 4br, 5br |

| Number of Units | 380 |

| Site Area | 100,104 sq ft |

| Gross Floor Area (GFA) | Approx. 350,031.6 sq ft |

Located right next to Great World City MRT Station (Thomson-East Coast Line) and in the exclusive and affluent River Valley district, River Green is most likely going to be highly sought-after for families and investors.

Being located within 1km to River Valley Primary and Alexandra Primary and 2km to St Margaret’s Primary, families with young children seeking a private new home will see River Green as an ideal nest for their child’s primary school years.

River Green is expected to commence preview at Q3 2025.

Newport Residences 铂海峰

| Location | Anson Road |

| District | D02 – Chinatown / Tanjong Pagar |

| Mukim/Lot No. | TS03 00595K |

| Developer | Hong Leong Properties Pte Limited (A wholly owned subsidiary of City Developments Limited) |

| Tenure | Freehold |

| Tenure Commenced From | NA |

| Expected TOP | Mar 2030 |

| Unit Type | Studio, 1br, 2br, 3br, 4br, Penthouse |

| Number of Units | Residential:246 (Level 23 to 45), Service Apartment: 197 |

| Site Area | Approx. 54,802 sq ft |

| Gross Floor Area (GFA) | Approx. 655,000 sq ft |

Newport Residences is part of the larger Newport Plaza (铂海峰大厦) development, which includes Newport Tower (铂海中心) – which is the commercial and office component, and Newport Residences (铂海峰) – residential component.

If you are a property investor or homeowner who really value freehold properties, Newport Residences is really one to take note. The site of Newport Residences will be right beside the Urban Redevelopment Authority’s upcoming Greater Southern Waterfront development.

Greater Southern Waterfront refers to the transformation along Singapore’s southern coast from Pasir Panjang to Marina East. It will be transformed into a new major gateway and location for urban living beside the sea.

Newport Residences has 1 tower of 45-storey mixed development comprising service apartment and residential apartments, and a 9-storey podium consisting of commercial/office and communal offices.

Newport Residences is expected to commence preview in the later part of 2025.

21 Anderson

| Location | Anderson Road |

| District | D10 – Tanglin / Holland / Bukit Timah |

| Mukim/Lot No. | TS25 01519T and 01851T |

| Developer | Anderson International Properties Pte. Ltd & Raffles Legend Properties Pte. Ltd |

| Tenure | Freehold |

| Tenure Commenced From | NA |

| Expected TOP | 2029 |

| Unit Type | Studio, 2br, 4br, Penthouse |

| Number of Units | 18 |

| Site Area | 50,166 sq ft |

| Gross Floor Area (GFA) | TBC |

21 Anderson is a very exclusive development – with only 18 units. And even before preview, 8 have already been reserved! (As of 15 Apr 2025). Yet, the site area (50,166 sq ft) is almost as large as Newport Residences (54,802 sq ft). This means more living spaces for the 18 residences and more spacious communal facilities too. The size of a 2-bedder unit starts at 3,197 sqft, and 4,500 sq ft for a 4-bed unit! Great for individuals or families requiring larger spaces.

Located near the Orchard area and just a short walk from Stevens MRT station (Downtown and Thomson-East Coast Lines), the 10-storey new condominium has Ernesto Bedmar as the architect and the zen-themed landscape spaces designed by Shunmyo Masuno.

21 Anderson has commenced preview in Apr 2025 and is available for showflat viewing on an appointment basis.

The Robertson Opus

| Location | 11 Unity Street |

| District | D09 – Orchard / River Valley |

| Mukim/Lot No. | TS09 00245X, 00246L |

| Developer | RIVERSIDE PROPERTY PTE. LTD (Frasers Property Limited and Sekisui House) |

| Tenure | 999 years leasehold |

| Tenure Commenced From | NA |

| Expected TOP | 2029 |

| Unit Type | Studio, 2br, 4br, Penthouse |

| Number of Units | 348 |

| Site Area | Approx. 97,983 sq ft |

| Gross Floor Area (GFA) | 352,647.2 sq ft (304,963.1 sq ft Residential + 47,684.12 sq ft Commercial) |

The Robertson Opus seems to have everything – 999-year leasehold, superb connectivity to 4 MRT lines, 5-min walk to Fort Canning MRT station, mixed-use development with retail shops, close to Fort Canning Park, within 1km from River Valley Primary School, being part of the Singapore River scene at Robertson Quay, and being located in the CCR. There is a lot to like about this development.

This development is located on the site of the former Robertson Walk, and is sure to be banking on the luxury riverside living experience. For people who value properties that can be passed on through generations, the 999-year lease will be very appealing to them too.

The Robertson Opus is expected to commence preview in Q3 2025.

Comparative analysis of CCR new launch condo projects

How the key data stack up between the CCR new launch condos

There’s a lot of information on the CCR condominium launches to cramp in, but we will first focus on several metrics: Number of units, tenure and key feature(s).

| New Projects | District | Number of units | Tenure | Key Standout(s) |

| The Collective at One Sophia | D09 | 367 | 99 years | Right in between the busy districts of Bugis and Dhoby Ghaut |

| Aurea | D07 | 188 | 99 years | Being part of the conserved Golden Mile Complex and overlooking Kallang Basin |

| One Marina Gardens | D01 | 937 | 99 years | First mover advantage in the upcoming Marina South development |

| W Residences Marina View | D01 | 683 | 99 years | Hotel-living experience as it’s integrated with a 5-star hotel; right in the midst of the Marina South development |

| Orchard Boulevard Residences | D10 | 280 | 99 years | Walking distance to the bustling Orchard Road area |

| Holland Drive Residences | D10 | 680 | 99 years | Right next to the popular Holland Village estate known for its vibrant lifestyle |

| River Green | D09 | 380 | 99 years | Direct connection to Great World MRT station and sits in the well-known River Valley area |

| Newport Residences | D02 | 246 | Freehold | Going to enjoy massive transformation in the Greater Southern Waterfront and has both a commercial/office component and 197 service apartments |

| 21 Anderson | D10 | 18 (10 left) | Freehold | Units are exclusive and as large as a landed house! |

| The Robertson Opus | D09 | 348 | 999 years | Living by the Singapore River |

Number of units

In the Rest of Central Region (RCR) and Outside Central Region (OCR), many investors and buyers in Singapore may consider the size of the development when it comes to buying into the new project. The common perception is that developments that has at least 800 units or more are likely going to see more transactions once they hit the 3-year mark* (after purchase). More transactions usually mean prices are likely to change faster, as buyers usually refer to the recent past transactions when negotiating on a deal.

However, in the CCR, property buyers may view properties with a different set of metrics. It’s reasonable for property buyers to feel that developments with less number of units are likely to be more premium and more exclusive. Less people to share common facilities with, more privacy and more tranquillity.

Of the upcoming CCR projects, One Marina Gardens stands out. It is considered a large project with 937 units, and will likely see decent amount of transaction in the years to follow. Even so, this does not mean that other condo projects like The Collective at One Sophia (367 units), The Robertson Opus (348 units), Aurea (188 units) or Orchard Boulevard Residences (280 units) will see lower price appreciation or become harder to sell. One will have to consider other factors like rarity, locality and accessibility to the much needed amenities nearby for the right buyer.

Or you can go ultra boutique, like in 21 Anderson, which only has 18 units. It will be super exclusive as you will only have 17 other neighbours within the same building. But frequent transactions will be unlikely.

*In Singapore, most private residential property buyers (except executive condominium projects) will at least hold on to their units for at least 3 years before selling. If they sell within 3 years, they will have to pay Seller’s Stamp Duty (SSD), which is a form of tax for transacting residential properties too soon. SSD applies to industrial properties too.

Tenure

In Singapore, no one has the guarantee of owning a piece of land ‘forever’. Even for freehold land. The Land Acquisition Act allows the Singapore government to exercise their powers to acquire any land (freehold included) for public purposes like infrastructure development and public projects. In return, land or estate owners are compensated at market value. This is not exercised frequently, but there is such a power. So even if a land is freehold does not guarantee anything, but it is still a piece of ‘forever’ estate that can last beyond 1 generation or a single person’s lifetime.

More and more people are growing accustomed to leasehold properties (99 year lease), as they are cheaper compared to freehold, people may not have as much desire as before to leave behind estates to their children, and may just want to enjoy what they can during their lifetimes.

That said, for those who prefer something that can last multiple generations and preserve its value (and thus wealth) better, a freehold development will make more sense. Newport Residences and 21 Anderson and even The Robertson Opus stand out in this respect.

Key standout(s) amongst the upcoming launches in CCR

There are very diverse features with the different upcoming CCR projects. So it really depends on what you are looking out for. We break it down into the following:

Living where the youth, arts, heritage and entertainment are

The Collective at One Sophia is an ideal choice, given Bugis is a choice destination for all things arts, cultural and entertainment related. It also has Nanyang Academy of Fine Arts, Laselle College of the Arts combining to become the University of the Arts Singapore, making the area youth and arts centric.

Singapore’s major shopping street and the heart of retail

When people (both locally and abroad) speak about Singapore, they will identify Orchard Road when it comes to retail. Orchard Road is the major shopping street in Singapore, and a lot of the high-end shopping happens here.

Orchard Boulevard Residences (enjoying the same namesake) will have the advantage of being so near to such a shopping destination and this will likely attract a certain profile of property buyers.

Direct reach to popular enclaves and community living

There are a few estates that are well known for its particular resident demographic – such as River Valley (River Green), and Holland Village (Holland Drive Residences). People who are looking at popular resident enclaves are usually more affluent, love to be around their friends and enjoy a certain level of togetherness and quietness around the neighbourhood.

Being part of Singapore’s future transformations

The Greater Southern Waterfront is one to watch in the next decade or so, as Singapore aims to create waterfront living along the southern coast. Newport Residences will be able to witness and enjoy this transformation in the years to come, and this booster is likely to translate into tangible property value appreciation.

Experiencing ultra luxurious hotel-style living standard

It’s really rare to have a 5-star hotel (W Hotel) integrated with a condominium that you can fully own. W Residences Marina View will be only the 4th branded residence in the last 20 years and the first in Singapore to have direct integration with a hotel. This will be hotel-standard facilities and hotel-style services that you can’t find in other private condos. It will be ideal for people who enjoy the feeling of having staycations all year round.

Super large living spaces

We were surprised ourselves when we discovered that the units in 21 Anderson are comparable to a landed house! And it has communal facilities too, which is something that landed properties do not have. This is a development that is ultra exclusive and for ultra high net worth individuals (UHNWI) who seek privacy and away from the limelight.

Conclusion

2025 is an exciting year with the CCR’s expecting to have the largest launch pipeline in recent years. With 3,600 new units across nine condo projects, you’ll find excellent options from reputable developers at different price points, unit types and amenities.

There will be more details to follow on each project that is going to be launched, and we invite you to speak to us more if you want to seek more clarity and to get help identifying the right development for your needs.